Singapore property is often advertised as a safe-haven asset, in a low-tax environment. Coupled with a history of continued price appreciation, and a high-quality built environment, it’s no surprise that our real estate finds its way into many foreign portfolios. However, the Singapore property market is also unique in several ways; and foreigners are less often briefed about these issues. Buyers from overseas, take note of the following:

Table Of Contents

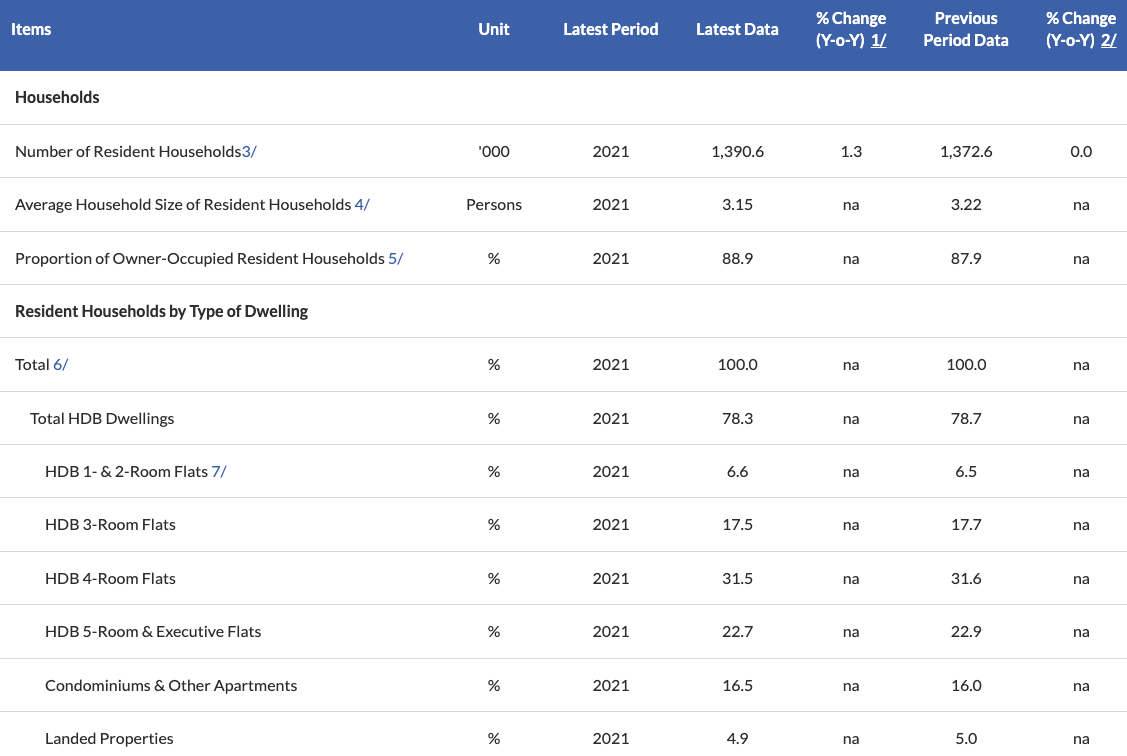

1. The homeownership rate in Singapore is around 90 per cent

Unlike many other property markets, our real estate rental is heavily dependent on foreigners. Only a handful of Singaporeans rent their homes; and this tends to be a temporary arrangement (e.g., they’re waiting for their homes to be built).

This represents a different risk profile from other real estate markets, where landlords can count on a mix of foreigners and locals to provide rental income. It also means that the rental market is dependent on government policies toward foreign labour.

If levies are raised for foreign labour, or quotas for foreign labour are tightened, this will affect the pool of available tenants. The impact will be more significant, compared to markets where locals can be relied upon for rental income.

2. The ABSD rate is not the same for all foreigners

If your country has a Free Trade Agreement (FTA) with Singapore, you may have a chance to get Additional Buyers Stamp Duty (ABSD) remission. At present, citizens of the USA, as well as citizens and Permanent Residents of Iceland, Liechtenstein, Norway, and Switzerland, pay the same ABSD rates as Singapore citizens.

For example: if you are both a Singapore Permanent Resident and a US citizen, you would pay no ABSD on your first property, and 17 per cent on your second property; exactly as a Singapore citizen would.

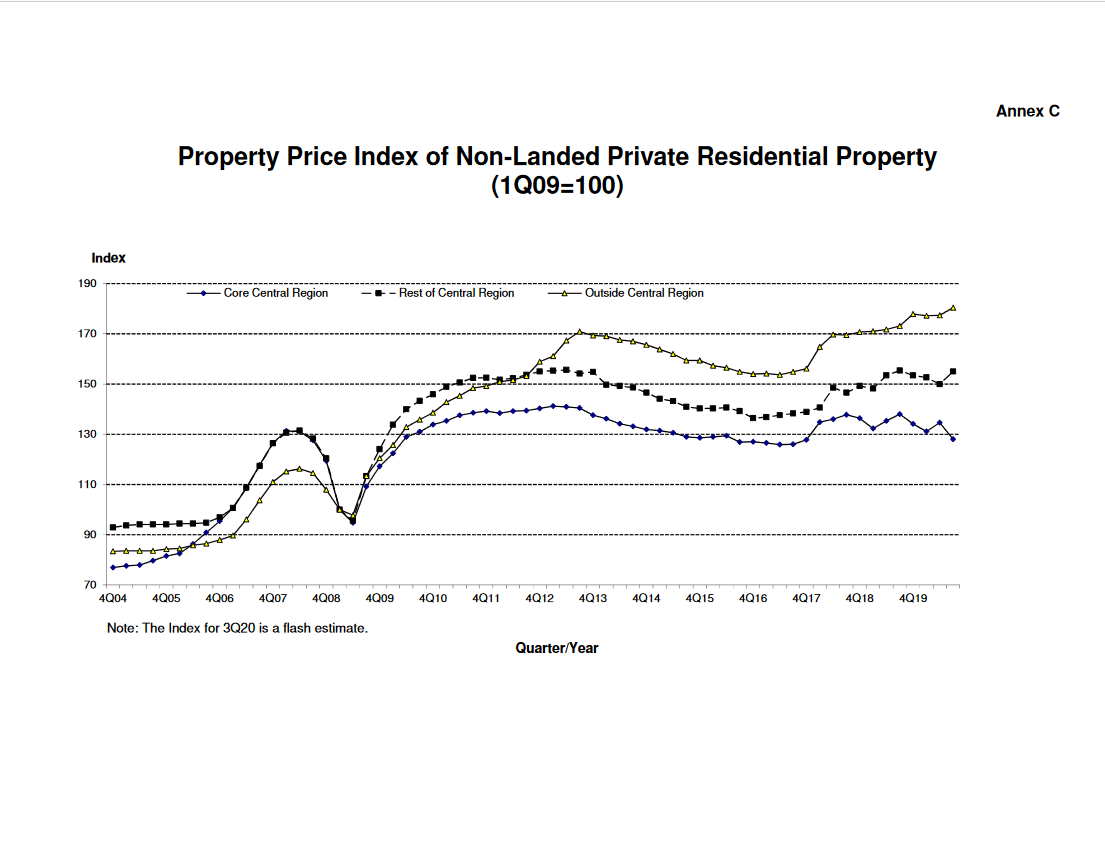

3. The Core Central Region (CCR) is almost an entirely different rental market from the rest of Singapore

If you’re a foreign investor, the first areas an real estate agent will highlight are districts in the Core Central Region (CCR). These include:

- District 1 (Boat Quay, Raffles Place)

- District 2 (Anson Road, Shenton Road, Tanjong Pagar)

- District 6 (High Street, City Hall)

- District 9 (Orchard, Cairnhill)

- District 10 (River Valley, Tanglin, Holland Village)

- District 11 (Bukit Timah, Newton)

Keep in mind that these are prime areas, which behave quite differently from the rest of the Singapore market. One example of this is the way CCR properties may be the first to bear the brunt of a downturn (this article from 2020 is a good demonstration of what can happen).

The key thing to note is that CCR properties are often rented on a corporate dime – as companies cut back and housing allowances shrink, tenants move into the outskirts. As such, non-central assets can sometimes outperform their CCR counterparts during downturns.

Also, note that many CCR properties are small units with a lower quantum but a higher price per square foot; this is to draw landlord buyers. The lower price and higher rental rate make for supposedly more attractive yields (your net rental yield may be lower due to higher maintenance costs). However, this also comes with a downside:

Most private home buyers in Singapore are upgraders, such as those selling their flats to buy condos, or those selling non-central condos to buy more upscale counterparts. This large buyer demographic tends to be families – and they are less inclined toward small one or two-bedders.

As such, you may find your small CCR unit performs well regarding rental yield; but that the unit is tougher to sell and less attractive in terms of resale gains.

4. Some “expat enclaves” are not always ideal for investment

A good reason example of this is Holland Village in District 10, where numerous launches have faced excessive competition. Another possible example is District 15 (around the Upper East Coast Road area), which is saturated with boutique condo units along the Katong stretch, and has large clusters of condos around the Parkway Parade area.

If an area is established as an expat enclave (i.e., it can be reasonably marketed to you as such), there would almost certainly be various rental properties in the area already; and you can expect fiercer competition from surrounding projects.

This also impacts future decisions to sell, as you’ll find just as many competing listings when the time comes. Keep in mind that when foreigners have to leave (either due to their job or family) to go back home, they will tend to want to sell the property than hold it. This means that even if it may not be the best period to sell, or that they may lose a little bit – they’d rather bite the bullet to do so.

5. Freehold properties may not always be ideal for landlords

In the Singapore property market, a freehold or 999-year leasehold property will typically be priced at 15 to 20 per cent more than a leasehold counterpart. However, tenants won’t care.

If the rental rate for projects in the area is $4,500 a month, your tenant will probably insist on no more than $4,500 a month: regardless of whether your property is a $1.6 million leasehold condo, or a $1.9 million freehold condo. Freehold status provides no tangible benefit to them.

As such, freehold often translates to lower rental yields for landlords, and lower overall gains if sold within a short period (leasehold counterparts can see a higher net gain, as they were bought for less).

Some agents may capitalise on your wariness about “the government taking back the property”, especially if you’re not familiar with limited-lease concepts back home; so do keep this in mind.

This is not to say freehold is always bad. Freehold can provide an edge if you intend to hold for a very long period (e.g., 20+ years or until en-bloc offers start being made). Also, you’ll find that many properties in the CCR are freehold, and there may be no leasehold counterparts nearby anyway.

6. Singapore is the most expensive country to own a car in, and this can affect real estate too

Singapore is consistently the most expensive country in which to own a car. The government’s rationale is that, given the extensive transport network, cars are never essential. At the same time, real estate agents tend to assume any foreign tenant in higher rent areas (e.g., near landed housing enclaves) can easily afford private transport anyway; or that they won’t mind using pricey cabs and ride-share vehicles, day-in, and day-out.

From word on the ground, however, we can assure you that some tenants – wealthier foreigners included – do mind. Even if they can afford the transport, it’s an issue of convenience: not everyone likes waiting 45+ minutes for their food delivery to turn up, or having to drive out for every meal.

One example of this is Sentosa. Some tenants tolerate the inconvenience for the exclusivity; but some have sworn off the island, due to the tedious drive to Vivo City or further, for necessities like groceries.

As such, foreign investors shouldn’t be too quick to buy in landed enclaves, which tend to be further from the country’s bus and MRT network. There’s merit to being near the train station, even if you think your tenants can probably afford to drive.

In general, there are some stereotypes that realtors – as well as locals – tend to place foreign property buyers in; and this can lead to obscuring some good options from you. Most, for instance, will assume you’re uninterested in fringe areas like Lentor, Changi, or even Sengkang. As the example from High Park Residences has shown (358 profitable transactions so far, zero unprofitable transactions, with the highest being a stunning $842,000) it’s not just the commonly focused central areas that are ones that you should look at.

Reach out to us at Stacked, so we can show you a wider range of opportunities. We’ll also provide you with in-depth reviews of new and resale properties alike.

Bagikan Berita Ini

0 Response to "6 Things Foreign Investors Are Seldom Told About The Singapore Property Market - Property Blog Singapore - Stacked"

Post a Comment