Commentary

7 min read

7 min read

Things are finally starting to calm down in Singapore’s private property market, with 2023 seeing the tail-end of the post-pandemic supply crunch. But for many buyers, complaints of high prices are still prevalent: private home prices may be flattening out, but many upgraders still struggle to afford true, family-sized units; and in every market segment, the threat of ever-rising interest rates is looming.

Here’s a look at how things worked out this year:

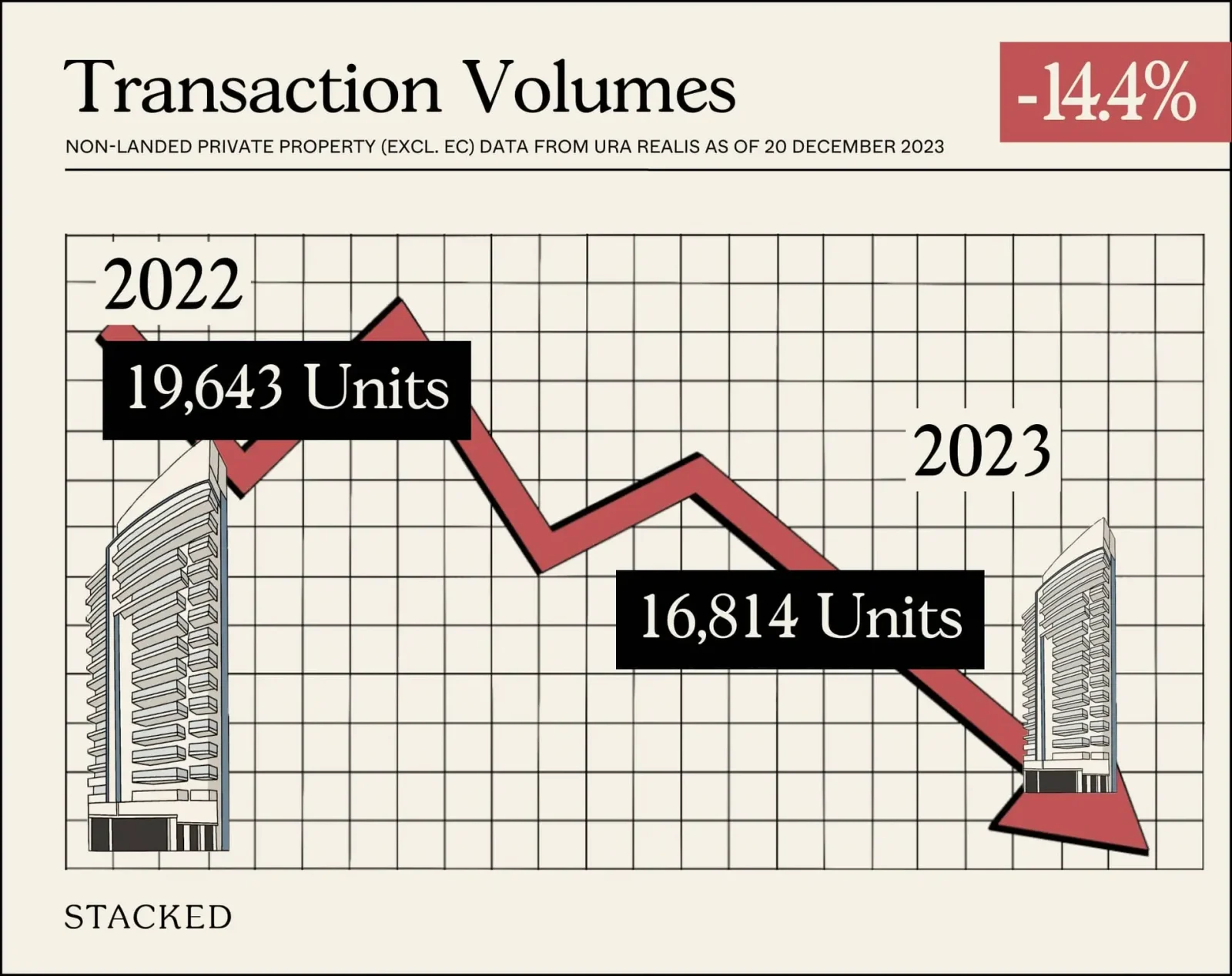

Transaction volumes for private non-landed homes

Volume for all non-landed homes excluding EC

Volume by type of sale (non-landed homes excluding EC)

| Type of Sale | 2022 | 2023 | Change |

| New Sale | 6,818 | 6,174 | -9.4% |

| Resale | 12,126 | 9,529 | -21.4% |

| Sub Sale | 699 | 1,111 | +58.9% |

| Total | 19,643 | 16,814 | -14.4% |

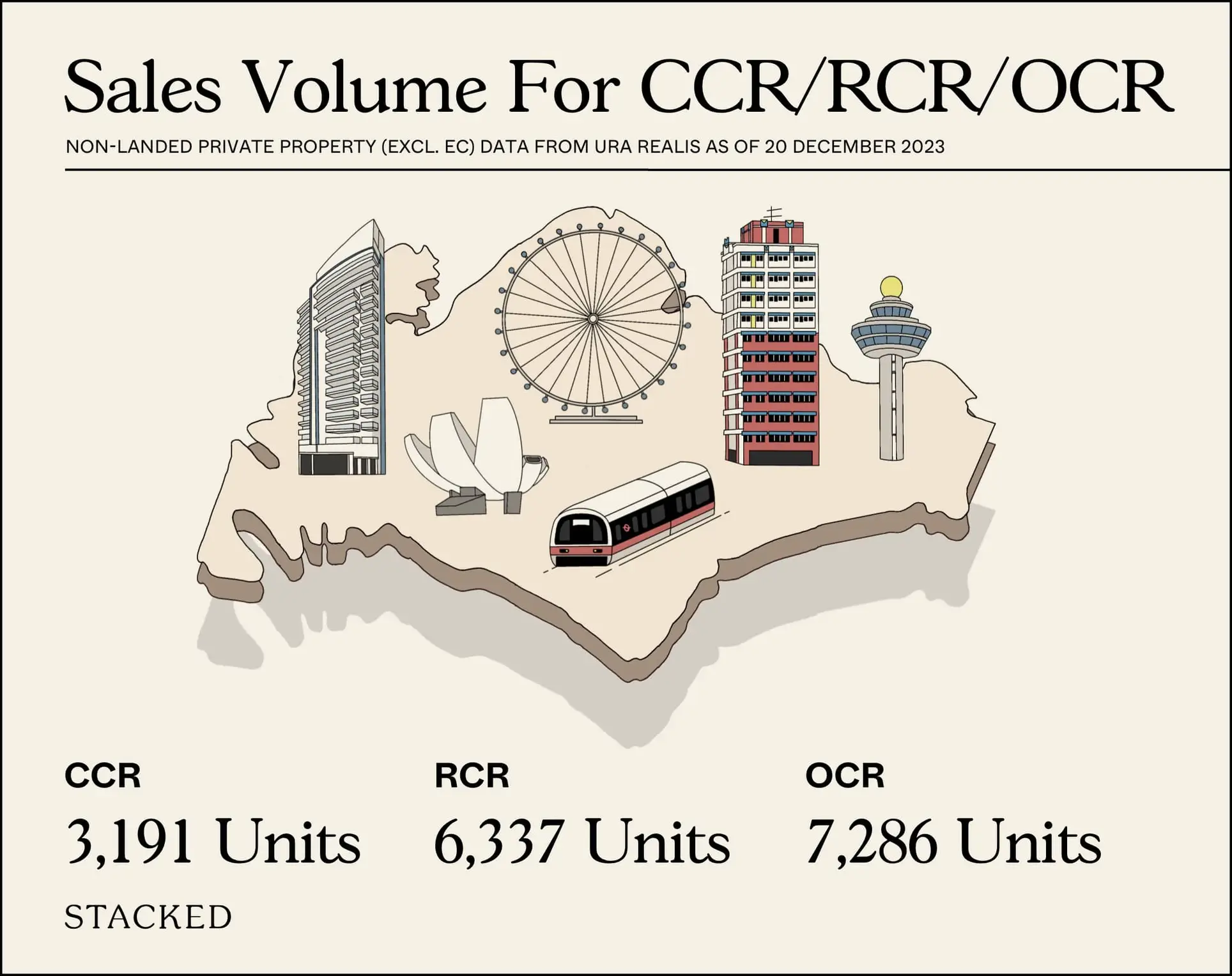

Volume by market segment (non-landed homes excluding EC)

| Market Segment | 2022 | 2023 | % Change |

| Core Central Region | 4,039 | 3191 | -21.0% |

| Outside Central Region | 9,089 | 7286 | -19.8% |

| Rest of Central Region | 6,515 | 6337 | -2.7% |

| Total | 19,643 | 16814 | -14.4% |

Overall, transaction volumes were down by 14.4 per cent from a year ago. The RCR saw the healthiest volumes for the year, barely down 22.7 per cent from 2022, while the CCR and OCR were both down by close to 20 per cent.

The stronger showing in the RCR is mostly due to the triple launch of The Continuum, Grand Dunman, and Tembusu Grand – all three projects are in District 15 in the RCR, and Grand Dunman is also a mega-development with 1,008 units. These were further supported by earlier new launches Pinetree Hill, The Landmark, and LIV@MB.

Some realtors were surprised at the weaker showing in the OCR though; some said they expected Lentor Hills and Lentor Modern would have helped to boost OCR transaction numbers. And while J’den was one of the most significant OCR successes toward the end of 2023, it is a rather small condo (368 units).

For the CCR, the drop in volume was expected and attributed to the 60 per cent ABSD rate slapped on foreigners (affluent foreign buyers make up a bigger portion of buyers in the CCR, compared to the other regions). Some projects – notably Pullman Residences – bucked the trend and saw strong sales anyway, but the recent cooling measure is taking its toll on this region.

A note on rising sub-sales

As always, these make up a very small portion of the market (this year, only 1,111 out of 16,814 transactions). Nonetheless, this number is an almost 59 per cent increase compared to the year before. Some realtors attributed this to buyers from 2019 and 2020, looking to realise strong gains over the past three to four years.

(We highlighted some of the more notable transactions in this article)

Realtors also opined that, among investment-oriented sellers, the rise in home loan interest rates may incentivise an earlier exit; possibly in the form of sub-sales.

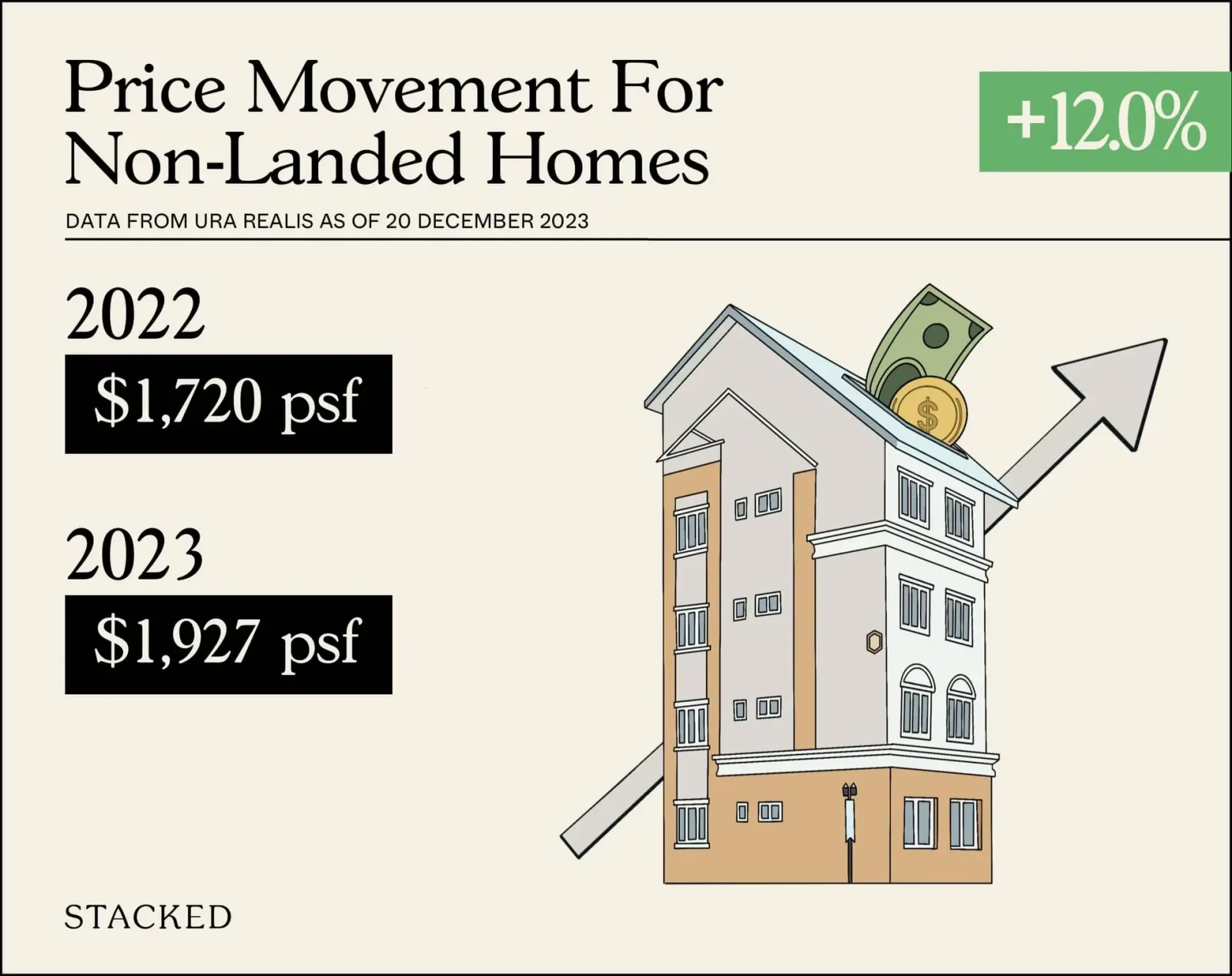

Price movements for private non-landed homes

Overall price movement

By Region

| Region | Sales volume (2022) | Price psf (2022) | Sales volume (2023) | Price psf (2023) | Approx. gain / loss |

| Singapore | 19,643 | $1,720 | 12.0% | $1,927 | +12.03% |

| CCR | 4,039 | $2,501 | 3,191 | $2,526 | +1.00% |

| OCR | 9,089 | $1,392 | 7,286 | $1,563 | +12.28% |

| RCR | 6,515 | $1,858 | 6,337 | $2,195 | +18.14% |

Looking at overall prices, there was a roughly 12 per cent increase in price psf across the board. Price movements correlate to volumes, subject to largely similar forces this year: a softer market in the CCR due to cooling measures, and an uptick in RCR prices due to a slate of recent new launches.

What isn’t reflected here, however, is the rapidly rising supply of homes. During the post-pandemic era, prices rose sharply due to a lack of housing; but as of end-2023, several major projects such as Jadescape, Normanton Park, and Treasure at Tampines are complete. These are among some of the largest mega-developments on the market.

Couple this with moderating rental demand (also due to improved supply), higher home loan rates, and the wait-and-see period that often follows new cooling measures, and prices will probably continue to slow in 2024.

All new launches in 2023

These new launches have recorded sales in 2023:

| Project Name | Total Number of Units in Project | Cumulative Units Sold to-date | Highest $PSF In 2023 | Lowest $PSF In 2023 | Median $PSF In 2023 | Take-Up Rate |

| 10 EVELYN | 56 | 31 | 3062 | 2700 | 2818 | 55.4% |

| 15 HOLLAND HILL | 57 | 57 | 3127 | 2710 | 2902 | 100.0% |

| 19 NASSIM | 101 | 12 | 3906 | 3036 | 3565 | 11.9% |

| AMBER PARK | 592 | 592 | 2784 | 1956 | 2480 | 100.0% |

| AMO RESIDENCE | 372 | 371 | 2443 | 2150 | 2281 | 99.7% |

| ATLASSIA | 31 | 23 | 2237 | 2036 | 2136 | 74.2% |

| BARTLEY VUE | 115 | 98 | 2010 | 1732 | 1921 | 85.2% |

| BAYWIND RESIDENCES | 24 | 24 | 2196 | 2080 | 2158 | 100.0% |

| BLOSSOMS BY THE PARK | 275 | 227 | 2730 | 2196 | 2441 | 82.5% |

| BOULEVARD 88 | 154 | 140 | 4010 | 3644 | 3753 | 90.9% |

| CAIRNHILL 16 | 39 | 39 | 3215 | 2587 | 2865 | 100.0% |

| CANNINGHILL PIERS | 696 | 680 | 3551 | 3002 | 3102 | 97.7% |

| CUSCADEN RESERVE | 192 | 11 | 3401 | 3401 | 3401 | 5.7% |

| DALVEY HAUS | 17 | 13 | 4301 | 3011 | 3577 | 76.5% |

| ENCHANTÉ | 25 | 10 | 2902 | 2725 | 2832 | 40.0% |

| FORETT AT BUKIT TIMAH | 633 | 633 | 2431 | 1909 | 1980 | 100.0% |

| GEMS VILLE | 24 | 1 | 1912 | 1912 | 1912 | 4.2% |

| GRAND DUNMAN | 1008 | 612 | 2819 | 2108 | 2522 | 60.7% |

| GRANGE 1866 | 60 | 35 | 3390 | 2796 | 3018 | 58.3% |

| HILL HOUSE | 72 | 18 | 3263 | 2880 | 3210 | 25.0% |

| HILLOCK GREEN | 474 | 132 | 2423 | 1882 | 2110 | 27.8% |

| HYLL ON HOLLAND | 319 | 319 | 3059 | 2603 | 2879 | 100.0% |

| IKIGAI | 16 | 11 | 2333 | 2238 | 2292 | 68.8% |

| IRWELL HILL RESIDENCES | 540 | 537 | 3091 | 2282 | 2996 | 99.4% |

| J’DEN | 368 | 330 | 2824 | 2109 | 2476 | 89.7% |

| JERVOIS MANSION | 130 | 105 | 2250 | 2250 | 2250 | 80.8% |

| JERVOIS PRIVE | 43 | 16 | 3229 | 2803 | 2923 | 37.2% |

| K SUITES | 19 | 4 | 2196 | 1919 | 2010 | 21.1% |

| KI RESIDENCES AT BROOKVALE | 660 | 654 | 2426 | 1860 | 2250 | 99.1% |

| KLIMT CAIRNHILL | 138 | 92 | 4645 | 3134 | 3555 | 66.7% |

| KOPAR AT NEWTON | 378 | 372 | 2952 | 2366 | 2550 | 98.4% |

| KOVAN JEWEL | 34 | 7 | 2173 | 2035 | 2126 | 20.6% |

| LAVENDER RESIDENCE | 17 | 10 | 2238 | 1710 | 1972 | 58.8% |

| LEEDON GREEN | 638 | 632 | 3467 | 2339 | 2942 | 99.1% |

| LENTOR HILLS RESIDENCES | 598 | 435 | 2451 | 1834 | 2107 | 72.7% |

| LENTOR MODERN | 605 | 578 | 2357 | 1918 | 2063 | 95.5% |

| LES MAISONS NASSIM | 14 | 14 | 5727 | 5050 | 5257 | 100.0% |

| LIV @ MB | 298 | 298 | 2909 | 2137 | 2449 | 100.0% |

| MEYER MANSION | 200 | 199 | 2900 | 2513 | 2787 | 99.5% |

| MIDTOWN BAY | 219 | 128 | 4086 | 2867 | 3231 | 58.4% |

| MIDTOWN MODERN | 558 | 538 | 4278 | 2583 | 2929 | 96.4% |

| MORI | 137 | 128 | 2329 | 1758 | 1891 | 93.4% |

| MYRA | 85 | 85 | 2712 | 1600 | 2345 | 100.0% |

| NEU AT NOVENA | 87 | 87 | 2970 | 2551 | 2580 | 100.0% |

| ONE BERNAM | 351 | 210 | 3344 | 2309 | 2620 | 59.8% |

| ONE HOLLAND VILLAGE RESIDENCES | 296 | 296 | 3391 | 2601 | 2881 | 100.0% |

| ONE PEARL BANK | 774 | 774 | 2976 | 2517 | 2765 | 100.0% |

| ORCHARD SOPHIA | 78 | 32 | 2895 | 2758 | 2816 | 41.0% |

| PARK NOVA | 54 | 53 | 4642 | 3213 | 3555 | 98.1% |

| PARKSUITES | 119 | 35 | 2477 | 2173 | 2371 | 29.4% |

| PARKWOOD RESIDENCES | 18 | 18 | 1860 | 1860 | 1860 | 100.0% |

| PARQ BELLA | 20 | 13 | 2385 | 1940 | 2312 | 65.0% |

| PASIR RIS 8 | 487 | 481 | 2101 | 1743 | 1766 | 98.8% |

| PEAK RESIDENCE | 90 | 90 | 2722 | 2295 | 2477 | 100.0% |

| PERFECT TEN | 230 | 225 | 3670 | 2942 | 3255 | 97.8% |

| PICCADILLY GRAND | 407 | 406 | 2174 | 1801 | 2046 | 99.8% |

| PINETREE HILL | 520 | 166 | 2705 | 2215 | 2370 | 31.9% |

| PULLMAN RESIDENCES NEWTON | 340 | 337 | 3729 | 2803 | 3217 | 99.1% |

| ROYAL HALLMARK | 32 | 30 | 2289 | 1907 | 2174 | 93.8% |

| RYMDEN 77 | 31 | 31 | 1659 | 1659 | 1659 | 100.0% |

| SANCTUARY@NEWTON | 38 | 2 | 2722 | 2571 | 2647 | 5.3% |

| SCENECA RESIDENCE | 268 | 174 | 2374 | 1896 | 2085 | 64.9% |

| SKY EDEN@BEDOK | 158 | 144 | 2177 | 1929 | 2107 | 91.1% |

| SKY EVERTON | 262 | 262 | 2957 | 2957 | 2957 | 100.0% |

| TEMBUSU GRAND | 638 | 376 | 2791 | 2280 | 2461 | 58.9% |

| TERRA HILL | 270 | 104 | 2922 | 2233 | 2695 | 38.5% |

| THE ARDEN | 105 | 47 | 1861 | 1565 | 1782 | 44.8% |

| THE ATELIER | 120 | 120 | 2984 | 2479 | 2679 | 100.0% |

| THE AVENIR | 376 | 376 | 3318 | 3011 | 3106 | 100.0% |

| THE BOTANY AT DAIRY FARM | 386 | 225 | 2402 | 1712 | 2065 | 58.3% |

| THE COMMODORE | 219 | 219 | 1590 | 1404 | 1528 | 100.0% |

| THE CONTINUUM | 816 | 290 | 3016 | 2573 | 2730 | 35.5% |

| THE LAKEGARDEN RESIDENCES | 306 | 95 | 2362 | 1880 | 2103 | 31.0% |

| THE LANDMARK | 396 | 317 | 3108 | 2272 | 2651 | 80.1% |

| THE M | 522 | 520 | 3322 | 2508 | 2990 | 99.6% |

| THE MYST | 408 | 179 | 2323 | 1897 | 2070 | 43.9% |

| THE REEF AT KING’S DOCK | 429 | 416 | 2738 | 2373 | 2625 | 97.0% |

| THE RESERVE RESIDENCES | 732 | 661 | 2873 | 2197 | 2473 | 90.3% |

| THE SHOREFRONT | 23 | 4 | 1919 | 1767 | 1899 | 17.4% |

| TMW MAXWELL | 324 | 6 | 3739 | 3143 | 3337 | 1.9% |

| VAN HOLLAND | 69 | 69 | 3193 | 2484 | 2865 | 100.0% |

| WATTEN HOUSE | 180 | 111 | 3545 | 3077 | 3200 | 61.7% |

| WILSHIRE RESIDENCES | 85 | 85 | 2919 | 2612 | 2780 | 100.0% |

| ZYANYA | 34 | 26 | 1926 | 1790 | 1891 | 76.5% |

Take-up rates may differ slightly from the exact end-of-year numbers, as this was written just over a week prior to the end of 2023.

Top selling projects for 2023

| Project Name | Sold In 2023 | Median $PSF In 2023 | Median Price In 2023 | Tenure |

| THE RESERVE RESIDENCES | 662 | $2,473 | $1,856,463 | 99 yrs from 29/11/2021 |

| GRAND DUNMAN | 612 | $2,522 | $1,985,000 | 99 yrs from 12/09/2022 |

| LENTOR HILLS RESIDENCES | 434 | $2,107 | $1,628,000 | 99 yrs from 25/04/2022 |

| TEMBUSU GRAND | 376 | $2,461 | $1,833,000 | 99 yrs from 25/04/2022 |

| J’DEN | 328 | $2,476 | $2,075,500 | 99 yrs from 01/03/1991 |

2023 ended with the normalisation of new launch prices at over $2,100 psf, and a median quantum of over $1.8 million for a new launch, family-sized condo unit.

Top-selling CCR projects

| Project Name | Sold In 2023 | Median $PSF In 2023 | Median Price In 2023 | Tenure |

| LEEDON GREEN | 632 | $2,942 | $2,016,000 | Freehold |

| PULLMAN RESIDENCES NEWTON | 337 | $3,217 | $2,158,000 | Freehold |

| WATTEN HOUSE | 111 | $3,200 | $4,996,000 | Freehold |

| THE ATELIER | 120 | $2,679 | $2,379,405 | Freehold |

| KLIMT CAIRNHILL | 92 | $3,555 | $5,575,000 | Freehold |

Top selling RCR projects

| Project Name | Sold In 2023 | Median $PSF In 2023 | Median Price In 2023 | Tenure |

| THE RESERVE RESIDENCES | 661 | $2,473 | $1,856,463 | 99 yrs from 29/11/2021 |

| GRAND DUNMAN | 612 | $2,522 | $1,985,000 | 99 yrs from 12/09/2022 |

| TEMBUSU GRAND | 376 | $2,461 | $1,833,000 | 99 yrs from 25/04/2022 |

| THE CONTINUUM | 290 | $2,730 | $1,989,000 | Freehold |

| BLOSSOMS BY THE PARK | 227 | $2,441 | $1,857,000 | 99 yrs from 10/01/2022 |

Top selling OCR projects

| Project Name | Sold In 2023 | Median $PSF In 2023 | Median Price In 2023 | Tenure |

| LENTOR HILLS RESIDENCES | 435 | $2,107 | $1,628,000 | 99 yrs from 25/04/2022 |

| J’DEN | 330 | $2,476 | $2,075,500 | 99 yrs from 01/03/1991 |

| THE BOTANY AT DAIRY FARM | 225 | $2,065 | $1,513,000 | 99 yrs from 18/06/2022 |

| THE MYST | 179 | $2,070 | $1,458,000 | 99 yrs from 11/05/2023 |

| SCENECA RESIDENCE | 174 | $2,085 | $1,571,000 | 99 yrs from 10/02/2021 |

Resale project performance in 2023

Realtors told us they saw problems with inventory, toward the end of 2023. It wasn’t just a struggle to find buyers in the expensive market, it was getting increasingly tough to find sellers.

This was attributed to the cost of a replacement property: high prices offset much of the gains from HDB resale prices, or even some condos. In addition, those who owned second properties were less willing to sell, as buying again in future would mean incurring 20 per cent ABSD (for Singaporean buyers).

As such, good resale units may have been a bit tougher to find, by around mid-2023.

Top 5 resale performers

| Project | Sale Date | Transacted | Quantum Gains | % Gain | Holding Period (Years) |

| THE WINDSOR | 16/8/23 | $3,410,000 | $2,660,000 | 355% | 18 |

| TEXTILE CENTRE | 3/10/2023 | $990,000 | $765,000 | 340% | 20.6 |

| SHERWOOD TOWER | 30/1/23 | $1,380,000 | $1,060,000 | 331% | 18.1 |

| THE CENTREPOINT | 30/3/23 | $2,100,000 | $1,608,000 | 327% | 16.9 |

| THE CENTREPOINT | 27/4/23 | 2100000 | $1,600,000 | 320% | 23.1 |

Bottom 5 resale performers

| Project | Sale Date | Transacted | Quantum Loss | % Loss | Holding Period (Years) |

| HELIOS RESIDENCES | 21/4/23 | $3,150,000 | -$1,833,000 | -37% | 10.5 |

| MARINA BAY RESIDENCES | 18/10/23 | $6,900,000 | -$2,390,000 | -26% | 9.6 |

| REFLECTIONS AT KEPPEL BAY | 17/1/23 | $3,068,000 | -$916,040 | -23% | 9.7 |

| 6 DERBYSHIRE | 31/8/23 | $920,000 | -$267,648 | -23% | 5.8 |

| THE SAIL @ MARINA BAY | 15/9/23 | $4,300,000 | -$1,178,480 | -22% | 14.2 |

This year’s surprise entry is Textile Centre, as it’s mainly thought of as a commercial building, and is not exactly the best-looking project along Beach Road/Bugis. There are also KTVs in the commercial podium, which is usually unattractive to buyers – but perhaps the rising prominence of the Ophir-Rochor Corridor makes up for that.

For the bottom performers, the usual suspects are all present (Reflections at Keppel Bay, for instance, is a familiar name to market watchers: it intermittently makes the news for both the biggest losses and the biggest profits). We have a more detailed explanation of the performance of these luxury freehold projects here.

Rental market for private non-landed properties in 2023 (excluding ECs)

2023 saw a continuation of the brutal fall in supply and rise in rental prices. Needless to say, landlords were still in an advantageous position albeit the warnings that rental price increases are slowing down as sentiments points towards moderation.

The relentless rise has led to the government implementing a temporary increase in the occupancy cap for both private and HDB dwellings just recently.

Overall, leasing volume fell 16 per cent, to 72,466 leases from 86,506 the year before.

By market segment, the CCR saw the greatest dip of around 17 per cent while the RCR saw the smallest decrease of 15 per cent.

Volume of rental contracts

| Market Segment | 2022 | 2023 | Change |

| Core Central Region | 25,242 | 20,964 | -16.95% |

| Outside Central Region | 32,175 | 26,796 | -16.72% |

| Rest of Central Region | 29,089 | 24,706 | -15.07% |

| Total | 86,506 | 72,466 | -16.23% |

Rental price change by market segment

| Market Segment | 2022 | 2023 | Change |

| Core Central Region | $4.90 | $5.83 | +18.98% |

| Outside Central Region | $3.55 | $4.36 | +22.82% |

| Rest of Central Region | $4.35 | $5.35 | +22.99% |

| Total | $4.18 | $5.08 | +21.53% |

Top rental yield projects in 2023

| District | Project | Tenure | Completion | Average Price | No. of Transactions | Average Rent ($PSF PM) | # Rental Contracts | Yield (%) |

| 21 | THE HILLFORD | 60 YRS FROM 2013 | 2016 | 1,399 | 18 | 7.75 | 84 | 6.7 |

| 14 | LE REGAL | FREEHOLD | 2015 | 1,279 | 8 | 6.8 | 26 | 6.4 |

| 23 | LAUREL TREE | FREEHOLD | 2021 | 1,326 | 13 | 6.71 | 27 | 6.1 |

| 14 | PAVILION SQUARE | FREEHOLD | 2018 | 1,452 | 4 | 7.25 | 27 | 6 |

| 14 | GRANDVIEW SUITES | FREEHOLD | 2016 | 1,131 | 5 | 5.46 | 16 | 5.8 |

Bottom rental yield projects in 2023

| District | Project | Tenure | Completion | Average Price | No. of Transactions | Average Rent ($PSF PM) | # Rental Contracts | Yield (%) |

| 15 | KING’S MANSION | FREEHOLD | 1982 | 1,877 | 5 | 3.14 | 29 | 2 |

| 10 | ARDMORE PARK | FREEHOLD | 2001 | 4,317 | 4 | 7.16 | 74 | 2 |

| 15 | FERNWOOD TOWERS | FREEHOLD | 1994 | 1,739 | 5 | 3.1 | 36 | 2.1 |

| 10 | THE LADYHILL | FREEHOLD | 2002 | 2,617 | 4 | 4.65 | 5 | 2.1 |

| 10 | BISHOPSGATE RESIDENCES | FREEHOLD | 2012 | 3,688 | 4 | 6.54 | 5 | 2.1 |

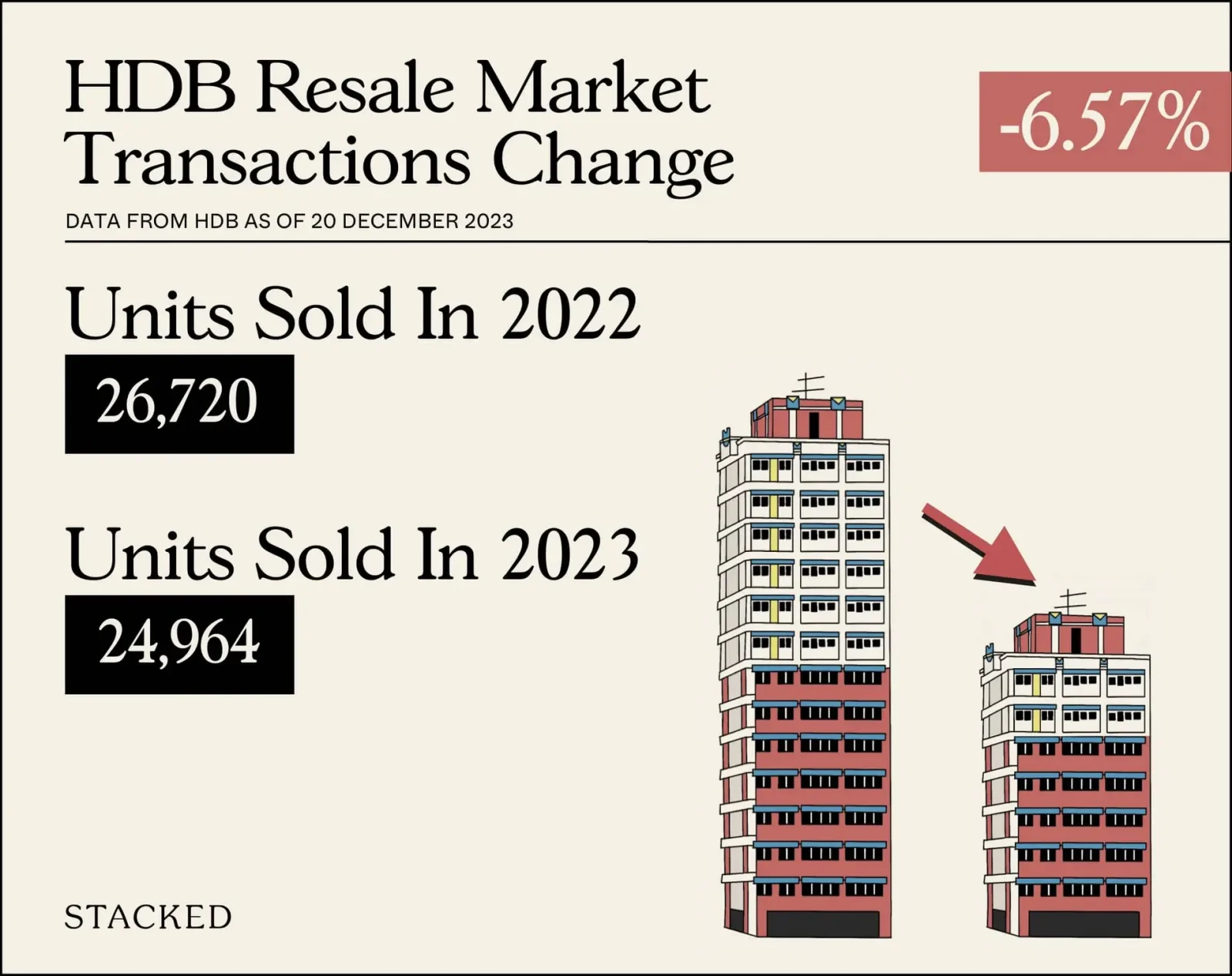

HDB resale market

2023 saw HDB volumes fell by 6.57 per cent from 26,720 to 24,964 which follows a similar trend between 2021 and 2022.

In terms of prices, 2-room flats saw the highest price increase – also similar between 2021 to 2022 at 9.1 per cent. This was followed by 7.8 per cent for multi-generational flats.

5-room flats saw the smallest increase in price of 4.4%. This is similar to 2022 when 5-room flats also saw the smallest increase in price at 8%.

Resale transaction volume in 2023

Resale transaction by flat type

| Row Labels | 2022 Volume | 2022 Avg $PSF | 2023 Volume | 2023 Avg $PSF | Approx Gain/Loss |

| 1 ROOM | 10 | $692 | 6 | $728 | +5.2% |

| 2 ROOM | 456 | $603 | 660 | $658 | +9.1% |

| 3 ROOM | 6,335 | $532 | 6,159 | $562 | +5.6% |

| 4 ROOM | 11,309 | $541 | 10,999 | $574 | +6.1% |

| 5 ROOM | 6,713 | $519 | 5,681 | $542 | +4.4% |

| EXECUTIVE | 1,885 | $499 | 1,457 | $530 | +6.2% |

| MULTI-GENERATION | 12 | $513 | 2 | $553 | +7.8% |

| Grand Total | 26,720 | $532 | 24,964 | $564 | +6.0% |

BTO launches in 2023

| Estate | BTO | Launch | Est. Completion | Units |

| Bukit Merah | Alexandra Peaks | 5-Dec-23 | 59 months | 904 |

| Bedok | Chai Chee Green | 5-Dec-23 | 39 / 43 months | 1234 |

| Jurong West | Jurong Arcadia | 5-Dec-23 | 37 months | 716 |

| Bukit Panjang | Petir Park Edge | 5-Dec-23 | 48 months | 334 |

| Bishan | Sin Ming Residences | 5-Dec-23 | 32 months | 732 |

| Queenstown | Ulu Pandan Vista | 5-Dec-23 | 59 months | 890 |

| Woodlands | Urban Rise @ Woodlands | 5-Dec-23 | 51 months | 848 |

| Woodlands | Woodlands Beacon | 5-Dec-23 | 50 months | 399 |

| Choa Chu Kang | Rail Green I & II @ CCK | 4-Oct-23 | 39 months (Rail Green I @ CCK)/ 48 months (Rail Green II @ CCK) | 1895 |

| Tengah | Plantation Edge I & II | 4-Oct-23 | 36 months (Plantation Edge I)/ 40 months (Plantation Edge II) | 1010 |

| Kallang Whampoa | Rajah Residences | 4-Oct-23 | 52 months | 739 |

| Kallang Whampoa | Tenteram Vantage | 4-Oct-23 | 45 months | 1040 |

| Kallang Whampoa | Verandah @ Kallang | 4-Oct-23 | 42 months | 1143 |

| Queenstown | Tanglin Halt Cascadia | 4-Oct-23 | 54 months | 973 |

| Bedok | Bedok South Blossoms | 30-May-23 | 3Q 2027 | 1640 |

| Kallang Whampoa | Farrer Park Arena (PLH) | 30-May-23 | 4Q 2027 | 569 |

| Serangoon | Serangoon North Vista | 30-May-23 | 3Q 2027 | 330 |

| Tengah | Parc Meadow @ Tengah | 30-May-23 | 1Q 2027 – 2Q 2027 | 1985 |

| Tengah | Plantation Verge | 30-May-23 | 3Q 2027 | 971 |

| Tengah | Brickland Weave | 28-Feb-23 | 4Q 2027 | 1641 |

| Kallang Whampoa | Farrer Park Fields (PLH) | 28-Feb-23 | 2Q 2028 | 1274 |

| Jurong West | Jurong West Crystal | 28-Feb-23 | 3Q 2027 | 271 |

| Kallang Whampoa | Rajah Summit | 28-Feb-23 | 2Q 2028 | 510 |

| Queenstown | Ulu Pandan Glades (PLH) | 28-Feb-23 | 2Q 2029 | 732 |

Executive Condominium launch in 2023

2023 saw only 1 EC launch – Altura. The EC in Bukit Batok made headlines for setting a new record in prices which we’ve also covered extensively in our pricing review. Despite this, it’s almost 90% sold to date.

| Project | Units | Units Sold-To-Date | Lowest $PSF In 2022 | Highest $PSF In 2022 | Median $PSF In 2022 | Take-Up |

| ALTURA | 360 | 312 | 1325 | 1585 | 1478 | 86.7% |

Going into 2024

The combination of rising interest rates, higher housing supply, and even developers turning cautious signals a change in the market.

Genuine home buyers have a lot to look forward to: even if prices don’t drop, it’s likely that they’ve lost their upward momentum. And with the slew of newly completed projects, those seeking resale options may find a much wider range to choose from. Sellers, however, may soon need to adjust their expectations.

For more updates and news on the Singapore private property market, follow us on Stacked. We’ll also provide you with an in-depth look at new and resale projects alike.

Bagikan Berita Ini

0 Response to "2023 Year-End Review Of The Singapore Property Market: Key Numbers And Trends You Need To Know - Stacked"

Post a Comment