Commentary

5 min read

5 min read

You’ve probably heard that it’s a bad idea to try and time the market, be it for stocks or real estate. But what about the opinions of analysts? Would the extensive research and data of a property firm help them to read the Singapore property market better? This is especially tricky in Singapore, where rental markets are almost wholly dependent on foreigners, and the government is quick to intervene. We checked out the analyst outlooks written the year before (2022) to see if they panned out:

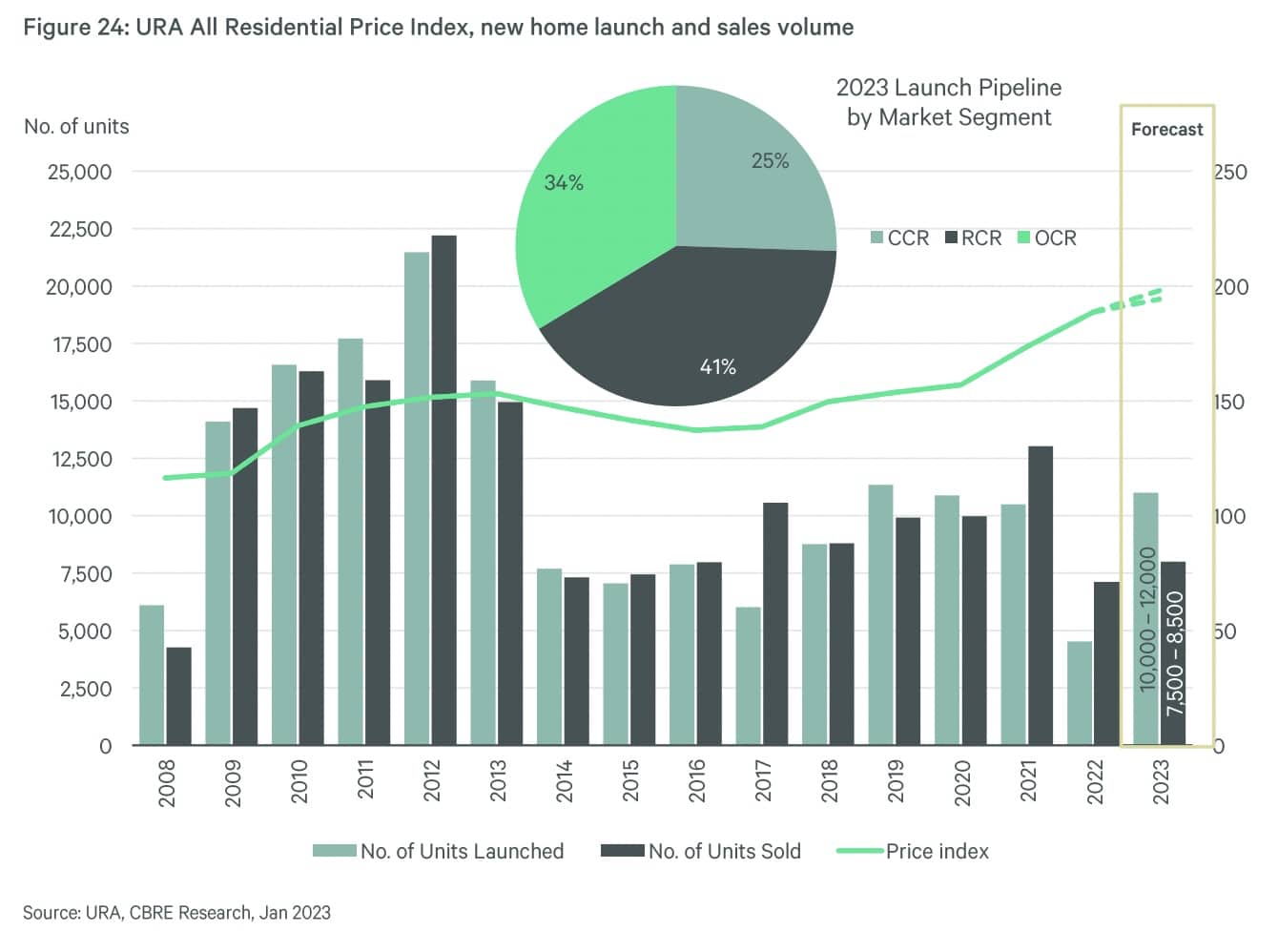

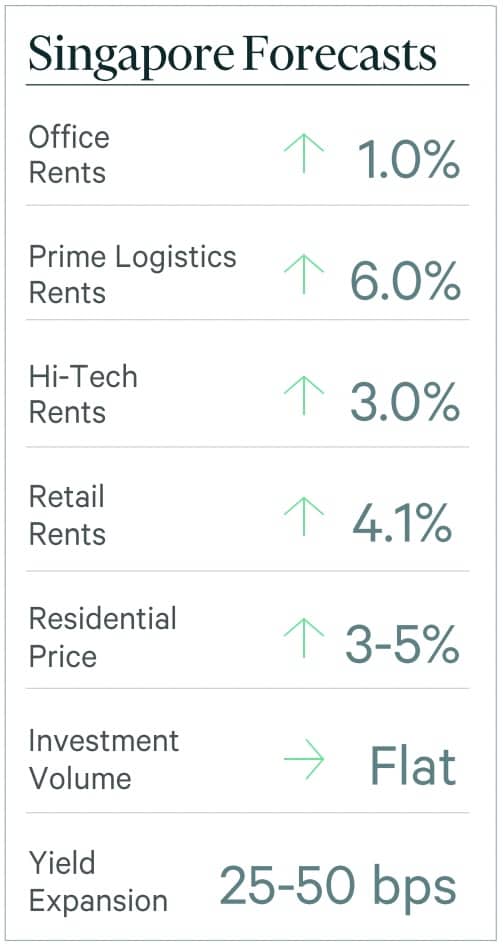

1. CBRE’s 2023 outlook

CBRE was mostly right about the supply pipeline, and the easing of the housing shortage to come. The outlook predicted 10,000 to 12,000 new units in 2023, which may only be a little bit higher than reality: according to URA, we were already at around 9,000 completed units (including ECs) during the previous quarter, so we’re coming in at the lower end of their predictions.

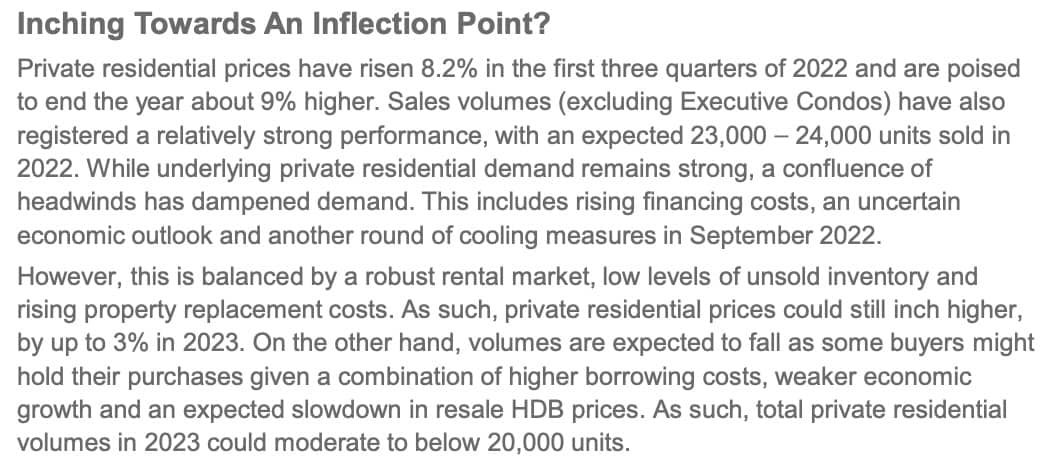

The estimate in this outlook predicted a rise of around three to five per cent in private home prices, in the face of a weaker economic outlook. We seem to be outdoing that by quite a bit though.

In terms of overall residential prices, this is looking to be broadly true. Note the above-linked report, where you can see the 2023 price index only moved from 186.6 to 196 in Q3; this was a 3.92 per cent increase, and well within the predicted range. As we’re almost at Q4 by this point, it’s likely that CBRE got it right.

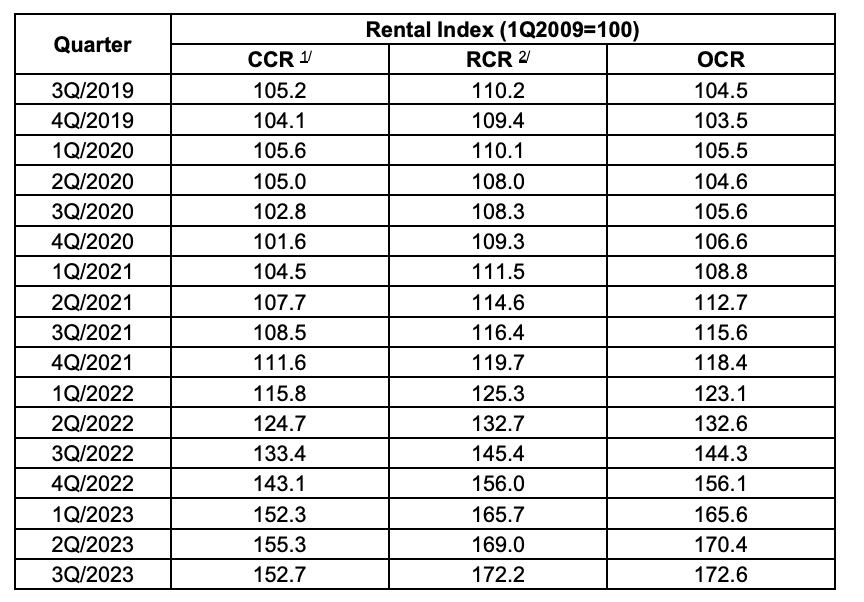

For rental rates, CBRE predicted some moderation would occur. According to the rental price index though, we went from 148.1 to 164.5 YoY. This is an increase of 11.1 per cent. However, we do think that, with the completion of very large projects like Treasure at Tampines and Normanton Park, there’s increasing downward pressure on rental rates going forward.

Given recent news and policy changes, we’re not sure CBRE’s prediction of Chinese buyers returning may pan out. While reasonable at the time, the imposition of a 60 per cent ABSD for foreign buyers – as well as potentially tighter compliance rules following money-laundering issues – brings doubt about a rising influx of Chinese buyers.

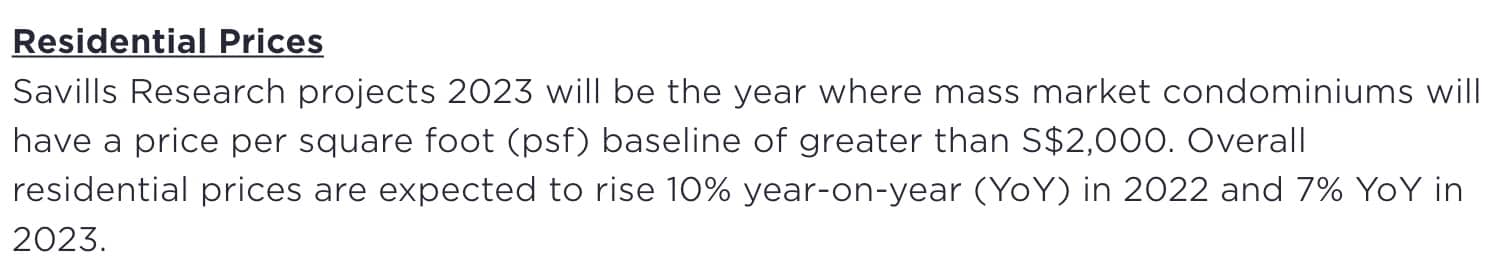

2. Savills 2023 outlook

Savills also predicted a moderation in prices, in the face of weakening economic outlooks. However, they also predicted that own-stay buyers (those not motivated by investment gains) would still pile into the housing market.

As such, Savills saw overall residential prices rising another seven per cent by end-2023. They also predicted that mass-market condos would reach a baseline of over $2,000 psf by 2023.

The prediction on overall prices was more optimistic than what we actually saw (see above), but they weren’t wrong about $2,000+ psf becoming a norm. This is, indeed, the typical launch price we now see even in OCR condos.

Savills prediction for rental rates was an increase in the five to 10 per cent range, YoY. This is very close to what we saw (as mentioned above, it was an 11.1 per cent increase).

It’s worth noting that Savills made an exception for the CCR, predicting rental rates would rise 15 per cent YoY in this region, due to supply issues. According to actual data from the year though, CCR rental rates has only increased by 6.7 per cent so far, as compared to the 10.4 per cent in the RCR and 10.6 per cent in the OCR.

3. Cushman & Wakefield’s 2023 outlook

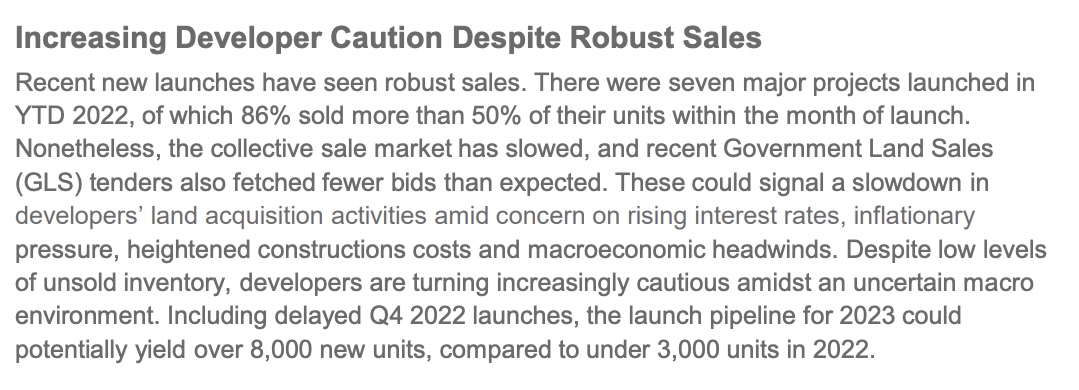

C&M correctly assessed the growing caution among developers, of which we saw many signs throughout the year. The expected “cyclical en-bloc fever” has also failed to manifest, despite the last tranche of 2017 properties long being redeveloped and sold. C&M’s prediction of 8,000 units entering the market is only a little bit under the actual 9,000 (see above).

C&M also expected private residential prices to moderate, predicting an increase of three per cent for 2023. This is off by less than a percentage point (the year is almost out and it’s up 3.92 per cent).

Interestingly, C&M also underestimated the rate at which rental rates would go up. They predicted five per cent in 2023, which is about half the actual increase (see above). Again, we agree with forecasts that rental will moderate; but it’s slower to come than most analysts have predicted.

4. PropertyGuru’s 2023 outlook

PropertyGuru also predicted that prices would moderate in 2023. There wasn’t a predicted range for the year, but the outlook ended on a note that prices would be mostly flat or rise only slightly, in the first six months for 2023.

This was close enough to reality: we when we checked on Square Foot Research, the overall private home prices actually dipped in the first six months:

Overall prices were at $1,842 psf in January 2023, but dipped to $1,786 psf (down around three per cent) by June that year.

PropertyGuru also noted that the increasing supply would have a “lagged effect”, which is consistent with what you’re seeing above: rental rates didn’t see as quick a drop as some analysts expected, because the increased supply will take a while to show its effect.

For homebuyers, do note that no one has mentioned falling prices

Prices are still going up, albeit at a slower pace. As such, your property agent may not be lying, when they tell you it’s going to be more expensive further down the road. Some may exaggerate how much more expensive it will be, but they’re probably right that it will be higher.

So while prices did moderate in 2023, it can be dangerous to gamble on whether we’re at an inflection point. Rather than try and time the market, make your property purchases based on your own financial situation – buy when you’re ready, not because you think the price is low or going up.

Follow us on Stacked for further updates on the Singapore property market, as well as reviews of new and resale homes alike.

Bagikan Berita Ini

0 Response to "How Well Did Property Experts Forecast Singapore's Property Trends? We Look Back At 2023 Market Predictions - Stacked"

Post a Comment