At this stage of cooling measures, there’s growing concern that even Singapore’s stable climate might put off foreign property investment. The Additional Buyers Stamp Duty (ABSD) rate for foreigners now stands at 30 per cent; this is against a backdrop of soaring interest rates, and restrictions against land ownership (e.g., foreigners can’t own freehold landed properties without special permission). A recent report on centi-millionaires by Henley & Partners, however, suggests even these may be irrelevant in deterring the super-rich from Singapore’s shores.

One of the major reasons is due to the migration of the super-rich. Given about 40 per cent of the world’s centi-millionaires are based in the US, it’s reasonable to assume that much of their wealth will be tied to the US dollar. Along with that comes risks such as political issues and the US national debt that’s approaching USD 31 trillion. For those who feel that the USD could never collapse, a recent example of the British Pound makes for grim reading.

As such, these centi-millionaires are seeing the need to move, be it to diversify their risks, for better education options, safer environments, etc.

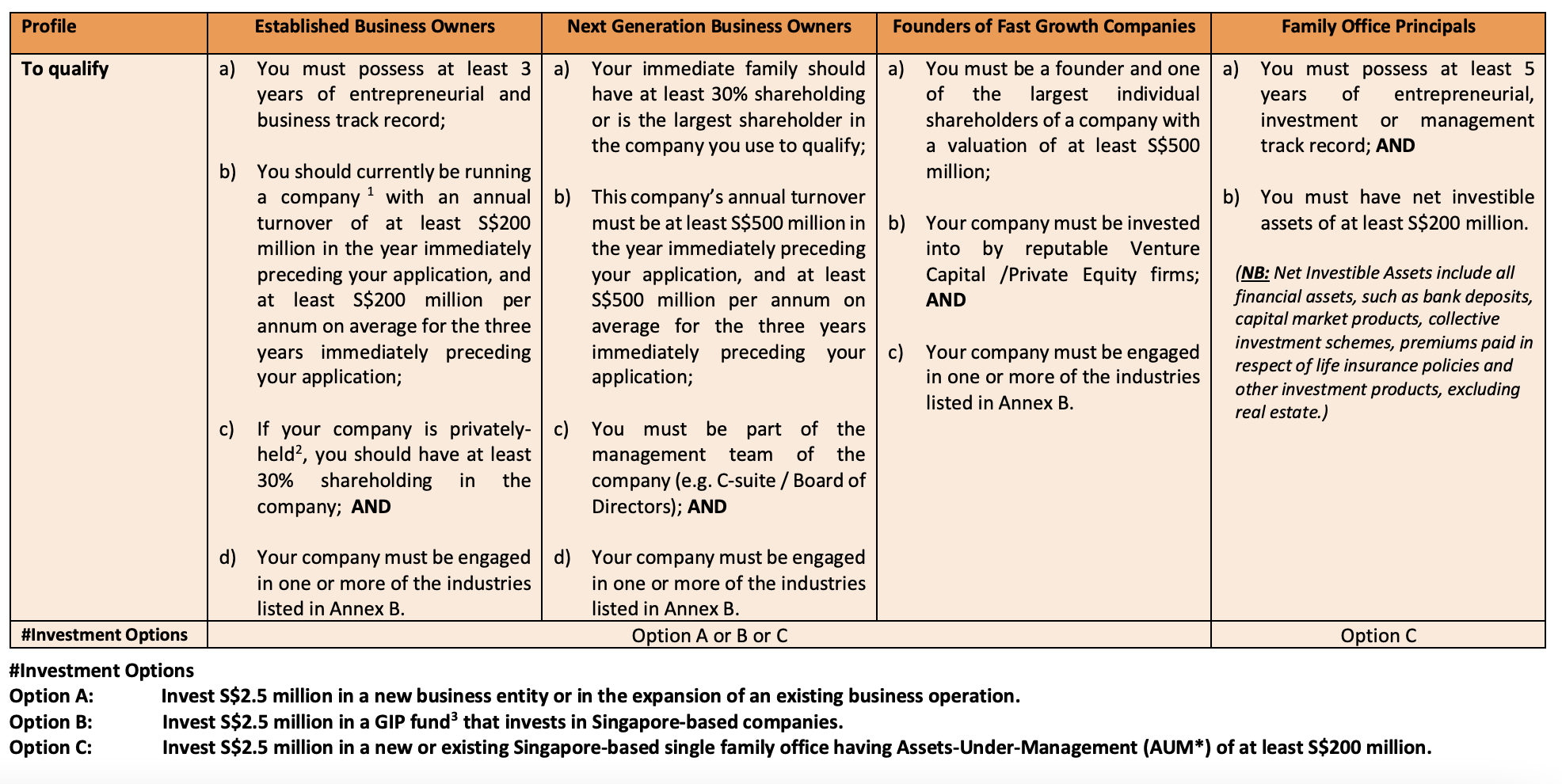

Clearly, Singapore is making moves to attract these super-rich. One of which is the Global Investor Programme (GIP) which accords Singapore Permanent Resident (PR) status to eligible global investors. Here’s the qualification profile below:

And according to a Hubbis article about how Singapore is a regional and global centre for UHNW wealth, it’s clear to see just what makes Singapore such an attractive place for the rich right now.

“They might say, yes, if I stay in my home country, I’m going to be paying high tax rates on my worldwide income, worldwide capital gains, I’m going to pay estate tax when I pass away, I’m going to pay gift tax when I make gifts. But in Singapore those are not applicable, and the family office and other structures offer additional incentives as well. Nowadays transparency is the norm, and secrecy is gone. Aside from incentives, Singapore also has many double tax treaties to help families invest in other countries as well. That is another huge advantage that Singapore offers.

We break down Henly & Partners report for you with 4 key points to note.

Table Of Contents

Singapore’s appeal to centi-millionaires:

Some of the key factors to note include:

- Singapore’s own centi-millionaires

- Not all foreigners pay ABSD

- Rise of family offices in the APAC region

- Singapore remains the most stable state in our region

1. Singapore’s own centi-millionaires

Singapore’s ultra-wealthy aren’t just attached to the local property market; it’s how most of them got to where they are. They’ve established the prevalent – and perhaps self-fulfilling – the belief that property ownership is the road to wealth.

As of 2022, the number of centi-millionaires in Singapore is creeping up the scale of the top 15 cities. We currently have around 336 centi-millionaires, and are ninth on the list of 15 cities.

As we saw in March last year, foreigners are quick to snap up luxury homes in Singapore; but it’s still local money that makes up the majority of buyers. And as of 2022, the proportion of foreign buyers has actually fallen, even as demand and private home prices rose.

So far, the signs seem clear that Singapore’s wealthiest sons and daughters still look to properties at home; and as Singaporeans get richer, our luxury developers still have a growing domestic market.

2. Not all foreigners pay ABSD

You’ll notice that the US cities make up the bulk of hotspots for centi-millionaires: this includes New York City, San Francisco, Los Angeles, Chicago, and Houston.

Given the increased volatility of US markets, and issues of high taxation, American centi-millionaires are likely to look beyond their own shores. At this point, it’s important to remember something about the ABSD:

American citizens pay the same ABSD rate as Singaporeans. This means, for instance, paying no ABSD on the first property they buy. Other exceptions include nationals and Permanent Residents of Iceland, Liechtenstein, Norway, and Switzerland.

While Americans don’t make up a large demographic of property buyers here, this may change as Singapore becomes more visible via economic ties, and the US pivot toward Asia.

It certainly doesn’t help that Americans can avoid ABSD, and that US citizens are less likely to pick China and India due to rising political tensions.

3. Rise of family offices in the APAC region

A 2021 Citibank report estimated that 10,000 family offices have been established across the world in the past two decades, a 10x increase from the early 2000s.

North America still has the largest share of family offices; but Asia-Pacific recorded the fastest growth of such entities, with a 44 per cent growth over the past two decades.

It’s believed that 229 family offices have been registered in Singapore since 2020.

Along with the rise in family offices come Permanent Residencies, and portfolios that seek exposure to Singapore’s prime real estate sector. It’s been noted, for instance, that newer family offices tend to prefer real estate and fixed income instruments over growth assets.

One private wealth manager we spoke to, on condition of anonymity, said that real estate in Singapore is still the easiest choice, even with the ABSD. She said that:

“If you want to invest in China, you must deal with the government’s strict capital controls, and now there has been a scare with the Evergrande situation. If you want to invest in places like Indonesia and Australia, there are strong controls on resale and gains; and in New Zealand many foreigners are outright banned from buying residential property.”

She also pointed out that Hong Kong, once Singapore’s closest rival in terms of real estate investment, is increasingly falling out of favour as political dissent mounts.

As such, these situations may see family offices directing their client’s wealth toward Singapore real estate, especially in the volatile years ahead.

4. Singapore remains the most stable state in our region

Love it or hate it, Singapore has proven itself to be one of the most stable countries in South East Asia. From the Asian Financial Crisis, through to the Global Financial Crisis and Covid-19, Singapore has made it through without revolts, protests in the streets, or knee-jerk economic decisions.

One side-benefit to this, mentioned in the report, is the stability of the Singapore dollar – like the Swiss franc, it’s a well-managed currency that represents a safe store of wealth; in some ways an analogy to the Singapore real estate sector.

So long as Singapore continues to demonstrate stability, its real estate segment – particularly the luxury half – is likely to keep drawing foreign investment; ABSD or not.

For more on the situation as it unfolds, follow us on Stacked. We’ll also provide you with in-depth reviews of new and resale projects alike.

Bagikan Berita Ini

0 Response to "Why Singapore Property Is A Hotspot For The Super Rich: The Rise Of The Centi-Millionaires - Property Blog Singapore - Stacked"

Post a Comment