That’s surprising, since subsale units usually cost more than new sale units (that’s usually the reason for the first buyer deciding to sell before completion). We don’t really have an explanation for this, other than perhaps higher interest rates giving some initial buyers cold feet.

| District | per cent Loss | Volume |

| 1 | -12 per cent | 66 |

| 2 | -7 per cent | 32 |

| 3 | -6 per cent | 13 |

| 4 | -12 per cent | 68 |

| 5 | -6 per cent | 22 |

| 7 | -5 per cent | 5 |

| 8 | -6 per cent | 18 |

| 9 | -13 per cent | 123 |

| 10 | -8 per cent | 52 |

| 11 | -8 per cent | 20 |

| 12 | -5 per cent | 16 |

| 13 | -6 per cent | 8 |

| 14 | -5 per cent | 36 |

| 15 | -6 per cent | 36 |

| 16 | -5 per cent | 45 |

| 17 | -2 per cent | 9 |

| 18 | -4 per cent | 9 |

| 19 | -4 per cent | 42 |

| 20 | -6 per cent | 5 |

| 21 | -3 per cent | 2 |

| 22 | -7 per cent | 3 |

| 23 | -4 per cent | 30 |

| 25 | -5 per cent | 9 |

| 27 | -5 per cent | 13 |

| 28 | -10 per cent | 21 |

The highest losses were in districts 1 (Marina Square, Boat Quay), 4 (Sentosa), and 9 (Cairnhill, Orchard).

This is unsurprising, as during the 2007-2012 property market period, projects such as Reflections At Keppel Bay (District 4) came up and saw a lot of losses. In District 1, projects such as The Sail @ Marina Bay, and Marina Bay Suites also saw a lot of losses. In District 9, projects such as Helios Residences and Scotts Square also saw big losses.

We can say that the higher activity in these areas is due to the return of affluent foreign buyers, as well as investors who foresee an uptick in the rental market. However, the highest losses also tended to come from these areas.

Prime region condos have a very high quantum, and discounts to move them tend to be quite substantial (this is partly why the “million-dollar Orchard/Sentosa loss” is almost a cliché). At these price levels, the price drops might not really cause a dent for some of these wealthy owners, and they would be more willing to sell at a big loss and move on than your average owner.

4. Freehold status didn’t seem to make much difference

For those who believe in freehold condos, we have some bad news. Among losses, freehold condos took a marginally worse hit, with losses averaging 8.49 per cent.

Leasehold condo losses averaged 8.05 per cent; perhaps due to their lower initial prices (freehold condos cost typically cost 15 to 20 per cent more as a rule of thumb).

It’s a slim gap between the two; but it does go to show that freehold doesn’t always make much difference.

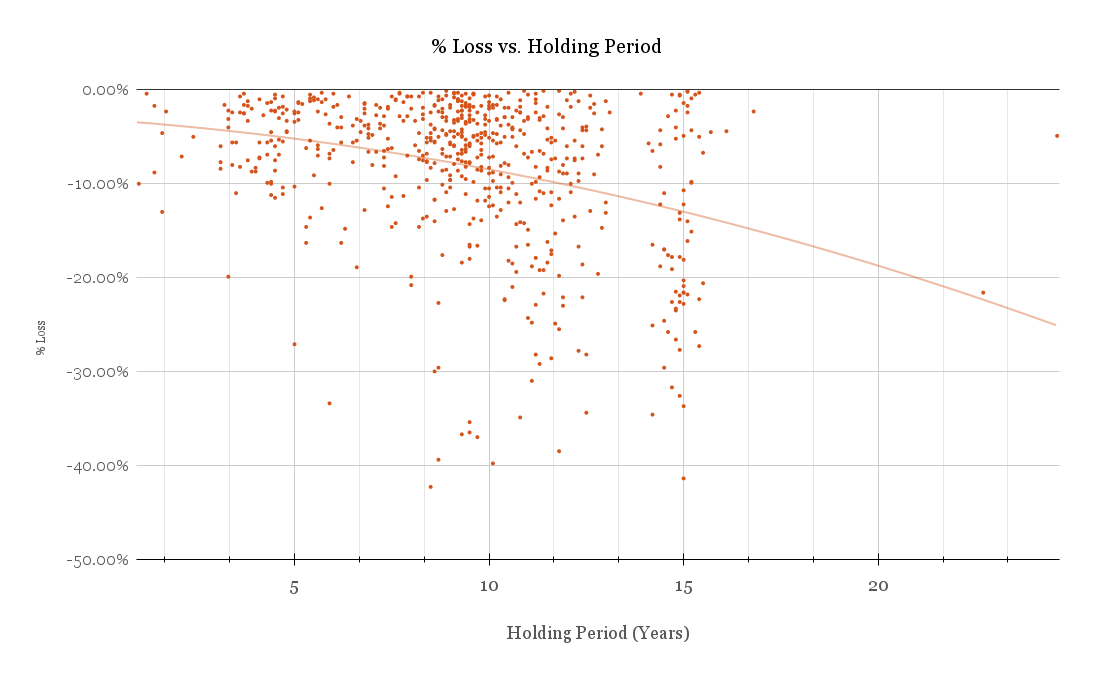

The oddest thing we found was that, among losing transactions, those with longer holding periods fared worse

Conventional wisdom holds that, the longer you hold a property, the higher the returns – or at least the lower the losses – should be. But when we plotted the holding period against the losses in a scatterplot, we found the opposite.

Before jumping to conclusion that “the longer you hold, the more you lose”, here’s what the scatterplot looks like if we take gains into consideration too:

So what could explain the strange pattern in the losses?

When we dug into the transaction data, we found some things of interest:

- Newton Planning Area saw 57 out of 733 losses with an average loss of 15 per cent. This is higher than the 8per cent loss on average across all areas. The majority were purchased in 2007 – 2012.

- The Southern Island Planning Area (Sentosa) saw 30 out of 733 losses, the average loss being 16 per cent.

- The Downtown Core Planning Area saw 96 out of 733 losses with an average loss of 10per cent (also mainly bought between 2007 – 2013)

- Bukit Merah (basically most of which are Reflections At Keppel Bay) had 60 out of 733 losses, averaging a 9per cent loss, and was purchased between 2007 – 2012.

Do you see a pattern here? Most were purchased between 2007 – 2012. As a result, the data is skewed towards heavier losses in the 10-15 year holding period.

This makes sense since during this period, property prices were moving fast which gave way to greater chances of property mispricing in the primary market. In other words, developers may have overhyped certain projects during the run-up in prices, and when reality came, these prices were not a true reflection (get it?!) of prices then.

To confirm this, we looked deeper and found the following:

- Newton: 60 per cent of losses were new sales, 3 per cent were sub sales

- Southern Island: 27 per cent were new sales, 40 per cent were sub sales

- Downtown Core: 52 per cent were new sales, 12.5 per cent were sub sales

- Bukit Merah: 65 per cent were new sales, 6 per cent were sub sales

As you can see, most of these purchases occurred in the primary market (or in the case of sub sales, when the project hasn’t reached TOP).

Apart from that, we also wanted to highlight two outliers in the scatterplot which registered losses even though they were held for more than two decades. This would be an extreme oddity in the market and are likely due to special circumstances (e.g., divorce, selling to their own children, or so forth).

| Project Name | Price | Size (sqft) | $PSF | Buy Price | Buy Date | Years Held | Quantum Loss | % Loss |

| CHELSEA GARDENS | $3,700,000 | 1959 | $1,889 | $3,890,000 | 6/12/1997 | 24.6 | -$190,000.00 | -4.9% |

| CHANGI GREEN | $980,000 | 872 | $1,124 | $1,250,000 | 10/1/1999 | 22.7 | -$270,000.00 | -21.6% |

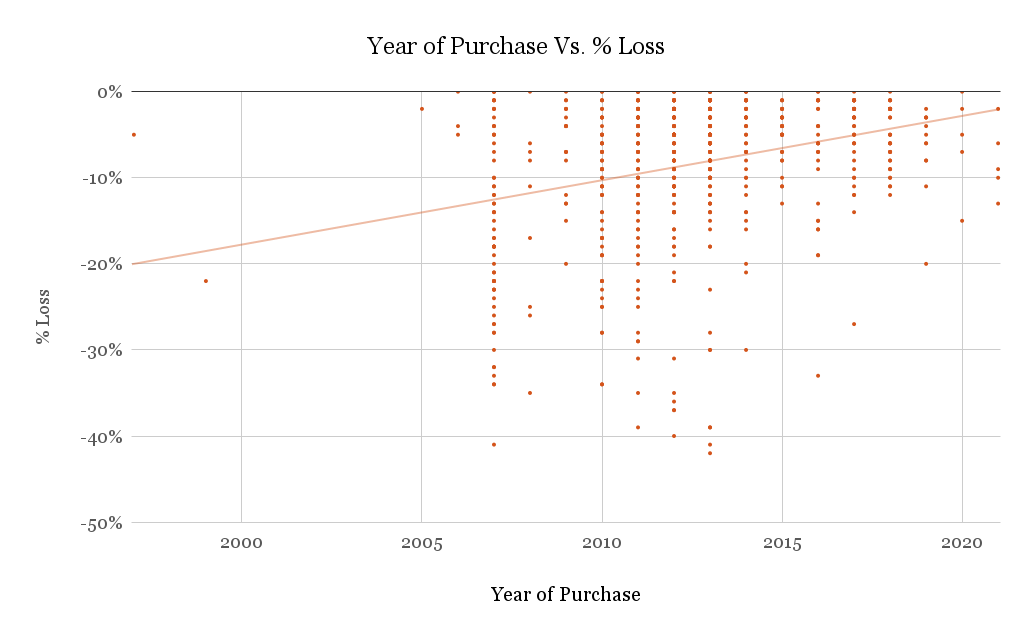

On a related note, here’s another way to view the losses:

Here we plot the year of the property purchase, to the percentage loss in its transaction. Again, you can see that a longer holding period seems to correspond to higher losses.

5. When it comes to property types, detached houses suffered the worst among losing transactions

| Property Type | Average of quantum | Average of percent_gain | Average of annualised_returns |

| Apartment | -$176,369 | -7.7% | -1.0% |

| Condominium | -$382,004 | -8.8% | -1.0% |

| Detached House | -$2,666,540 | -16.0% | -2.5% |

| Executive Condominium | -$58,600 | -5.4% | -0.6% |

| Semi-Detached House | -$350,012 | -8.2% | -1.6% |

| Terrace House | -$402,571 | -11.1% | -1.3% |

Detached houses lost around 16 per cent on average, with terrace houses following at a loss of about 11 per cent.

Among the losing transactions, Executive Condos (ECs) were the most spared, with average losses at just around 5.3 per cent.

This is likely due to the initial pricing of the properties. ECs are cheaper on average, which diminishes losses for the first batch of sellers.

Biggest losers by name

The following projects saw the biggest losses based on overall loss (quantum):

| Project Name | Price | Size (sqft) | $PSF | Buy Price | Buy Date | Years Held | Quantum Loss | % Loss | Annualised Loss | Type of Sale | Tenure |

| THE MARQ ON PATERSON HILL | $13,380,000 | 3089 | $4,331 | $20,542,400 | 40865 | 10.8 | -$7,162,400 | -34.90% | -3.90% | New Sale to Resale | Freehold |

| PATERSON SUITES | $13,800,000 | 6663 | $2,071 | $20,000,000 | 40865 | 11.1 | -$6,200,000 | -31.00% | -3.30% | Resale to Resale | Freehold |

| REFLECTIONS AT KEPPEL BAY | $5,850,000 | 3993 | $1,465 | $9,981,000 | 39212 | 15.0 | -$4,131,000 | -41.40% | -3.50% | New Sale to Resale | Leasehold |

| SEASCAPE | $5,900,000 | 3380 | $1,746 | $9,600,000 | 40555 | 11.8 | -$3,700,000 | -38.50% | -4.00% | New Sale to Resale | Leasehold |

| REFLECTIONS AT KEPPEL BAY | $12,200,000 | 6835 | $1,785 | $15,554,000 | 39321 | 15.0 | -$3,354,000 | -21.60% | -1.60% | New Sale to Resale | Leasehold |

| MARINA BAY SUITES | $5,000,000 | 2691 | $1,858 | $8,250,000 | 41619 | 8.7 | -$3,250,000 | -39.40% | -5.60% | New Sale to Resale | Leasehold |

| BELLE VUE RESIDENCES | $4,702,000 | 3552 | $1,324 | $7,400,000 | 41155 | 9.5 | -$2,698,000 | -36.50% | -4.70% | Resale to Resale | Freehold |

| THE LUMOS | $5,737,875 | 2433 | $2,359 | $8,433,000 | 39314 | 15.0 | -$2,695,125 | -32.00% | -2.50% | New Sale to Resale | Freehold |

| MARINA COLLECTION | $5,050,000 | 3412 | $1,480 | $7,700,000 | 40324 | 12.5 | -$2,650,000 | -34.40% | -3.30% | New Sale to Resale | Leasehold |

| CLIVEDEN AT GRANGE | $5,700,000 | 2153 | $2,648 | $8,341,040 | 39297 | 14.7 | -$2,641,040 | -31.70% | -2.60% | New Sale to Resale | Freehold |

| MARINA BAY RESIDENCES | $9,400,000 | 4435 | $2,120 | $11,979,000 | 39274 | 14.8 | -$2,579,000 | -21.50% | -1.60% | New Sale to Resale | Leasehold |

| CLIVEDEN AT GRANGE | $8,300,000 | 2842 | $2,921 | $10,824,540 | 39286 | 14.8 | -$2,524,540 | -23.30% | -1.80% | New Sale to Resale | Freehold |

| SILVERSEA | $9,500,000 | 4467 | $2,127 | $12,000,000 | 41745 | 8.0 | -$2,500,000 | -20.80% | -2.90% | New Sale to Resale | Leasehold |

| GRANGE INFINITE | $5,800,000 | 2573 | $2,255 | $8,236,533 | 39350 | 14.5 | -$2,436,533 | -29.60% | -2.40% | New Sale to Resale | Freehold |

| CLIVEDEN AT GRANGE | $8,000,000 | 2842 | $2,815 | $10,336,920 | 39235 | 14.9 | -$2,336,920 | -22.60% | -1.70% | New Sale to Resale | Freehold |

| CLIVEDEN AT GRANGE | $7,600,000 | 2842 | $2,674 | $9,935,000 | 39281 | 14.8 | -$2,335,000 | -23.50% | -1.80% | New Sale to Resale | Freehold |

| THE ARCADIA | $7,700,000 | 7503 | $1,026 | $10,000,000 | 40401 | 11.9 | -$2,300,000 | -23.00% | -2.20% | Resale to Resale | Leasehold |

| N.A. (8 Nassim Hill) | $9,790,000 | 4209 | $2,326 | $12,000,000 | 40407 | 11.5 | -$2,210,000 | -18.40% | -1.70% | New Sale to Resale | Freehold |

| MARINA COLLECTION | $3,700,000 | 2185 | $1,693 | $5,877,650 | 41192 | 9.7 | -$2,177,650 | -37.00% | -4.70% | Resale to Resale | Leasehold |

| CLIVEDEN AT GRANGE | $7,700,000 | 2842 | $2,710 | $9,864,600 | 39288 | 14.9 | -$2,164,600 | -21.90% | -1.70% | New Sale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1668 | $2,368 | $6,110,700 | 41158 | 9.5 | -$2,160,700 | -35.40% | -4.50% | Resale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1701 | $2,323 | $6,037,485 | 39497 | 14.2 | -$2,087,485 | -34.60% | -2.90% | Sub Sale to Resale | Freehold |

| HELIOS RESIDENCES | $2,800,000 | 1281 | $2,186 | $4,856,600 | 41473 | 8.5 | -$2,056,600 | -42.30% | -6.30% | Resale to Resale | Freehold |

| HELIOS RESIDENCES | $3,980,000 | 1701 | $2,340 | $6,000,000 | 39420 | 15.0 | -$2,020,000 | -33.70% | -2.70% | New Sale to Resale | Freehold |

| CITYVISTA RESIDENCES | $5,200,000 | 2626 | $1,980 | $7,152,996 | 39267 | 15.4 | -$1,952,996 | -27.30% | -2.10% | New Sale to Resale | Freehold |

| CITYVISTA RESIDENCES | $4,950,000 | 2626 | $1,885 | $6,827,600 | 39381 | 14.7 | -$1,877,600 | -27.50% | -2.20% | New Sale to Resale | Freehold |

| THE OCEANFRONT @ SENTOSA COVE | $6,730,000 | 3025 | $2,225 | $8,600,000 | 40486 | 11.4 | -$1,870,000 | -21.70% | -2.10% | Sub Sale to Resale | Leasehold |

| REFLECTIONS AT KEPPEL BAY | $7,308,000 | 3380 | $2,162 | $9,173,000 | 39321 | 15.0 | -$1,865,000 | -20.30% | -1.50% | New Sale to Resale | Leasehold |

| SEASCAPE | $4,280,000 | 2164 | $1,978 | $5,924,100 | 40296 | 12.3 | -$1,644,100 | -27.80% | -2.60% | New Sale to Resale | Leasehold |

| HELIOS RESIDENCES | $2,838,000 | 1281 | $2,216 | $4,481,500 | 41235 | 9.3 | -$1,643,500 | -36.70% | -4.80% | Resale to Resale | Freehold |

Here are the biggest losers by % loss:

| Project Name | Price | Size (sqft) | $PSF | Buy Price | Buy Date | Years Held | Quantum Loss | % Loss | Annualised Loss | Type of Sale | Tenure |

| HELIOS RESIDENCES | $2,800,000 | 1281 | $2,186 | $4,856,600 | 7/18/2013 | 8.5 | -$2,056,600 | -42.30% | -6.3% | Resale to Resale | Freehold |

| REFLECTIONS AT KEPPEL BAY | $5,850,000 | 3993 | $1,465 | $9,981,000 | 5/10/2007 | 15.0 | -$4,131,000 | -41.40% | -3.5% | New Sale to Resale | Leasehold |

| THE SCOTTS TOWER | $1,300,000 | 657 | $1,980 | $2,200,500 | 4/24/2013 | 9.5 | -$900,500 | -40.90% | -5.4% | New Sale to Resale | Leasehold |

| THE CLIFT | $1,400,000 | 829 | $1,689 | $2,326,400 | 7/9/2012 | 10.1 | -$926,400 | -39.80% | -4.9% | Resale to Resale | Leasehold |

| MARINA BAY SUITES | $5,000,000 | 2691 | $1,858 | $8,250,000 | 12/11/2013 | 8.7 | -$3,250,000 | -39.40% | -5.6% | New Sale to Resale | Leasehold |

| SEASCAPE | $5,900,000 | 3380 | $1,746 | $9,600,000 | 1/12/2011 | 11.8 | -$3,700,000 | -38.50% | -4.0% | New Sale to Resale | Leasehold |

| MARINA COLLECTION | $3,700,000 | 2185 | $1,693 | $5,877,650 | 10/10/2012 | 9.7 | -$2,177,650 | -37.00% | -4.7% | Resale to Resale | Leasehold |

| HELIOS RESIDENCES | $2,838,000 | 1281 | $2,216 | $4,481,500 | 11/22/2012 | 9.3 | -$1,643,500 | -36.70% | -4.8% | Resale to Resale | Freehold |

| BELLE VUE RESIDENCES | $4,702,000 | 3552 | $1,324 | $7,400,000 | 9/3/2012 | 9.5 | -$2,698,000 | -36.50% | -4.7% | Resale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1668 | $2,368 | $6,110,700 | 9/6/2012 | 9.5 | -$2,160,700 | -35.40% | -4.5% | Resale to Resale | Freehold |

| THE MARQ ON PATERSON HILL | $13,380,000 | 3089 | $4,331 | $20,542,400 | 11/18/2011 | 10.8 | -$7,162,400 | -34.90% | -3.9% | New Sale to Resale | Freehold |

| HELIOS RESIDENCES | $3,950,000 | 1701 | $2,323 | $6,037,485 | 2/19/2008 | 14.2 | -$2,087,485 | -34.60% | -2.9% | Sub Sale to Resale | Freehold |

| MARINA COLLECTION | $5,050,000 | 3412 | $1,480 | $7,700,000 | 5/26/2010 | 12.5 | -$2,650,000 | -34.40% | -3.3% | New Sale to Resale | Leasehold |

| HELIOS RESIDENCES | $3,058,000 | 1313 | $2,329 | $4,623,000 | 8/6/2007 | 15.3 | -$1,565,000 | -33.90% | -2.7% | New Sale to Resale | Freehold |

| HELIOS RESIDENCES | $3,980,000 | 1701 | $2,340 | $6,000,000 | 12/4/2007 | 15.0 | -$2,020,000 | -33.70% | -2.7% | New Sale to Resale | Freehold |

| OUE TWIN PEAKS | $1,238,000 | 570 | $2,170 | $1,858,605 | 12/28/2016 | 5.9 | -$620,605 | -33.40% | -6.6% | Resale to Resale | Leasehold |

| HELIOS RESIDENCES | $2,800,000 | 1313 | $2,132 | $4,152,000 | 7/31/2007 | 14.9 | -$1,352,000 | -32.60% | -2.6% | New Sale to Resale | Freehold |

| THE LUMOS | $5,737,875 | 2433 | $2,359 | $8,433,000 | 8/20/2007 | 15.0 | -$2,695,125 | -32.00% | -2.5% | New Sale to Resale | Freehold |

| CLIVEDEN AT GRANGE | $5,700,000 | 2153 | $2,648 | $8,341,040 | 8/3/2007 | 14.7 | -$2,641,040 | -31.70% | -2.6% | New Sale to Resale | Freehold |

| MARINA BAY SUITES | $3,100,000 | 1593 | $1,946 | $4,506,400 | 7/9/2012 | 9.7 | -$1,406,400 | -31.20% | -3.8% | New Sale to Resale | Leasehold |

| PATERSON SUITES | $13,800,000 | 6663 | $2,071 | $20,000,000 | 11/18/2011 | 11.1 | -$6,200,000 | -31.00% | -3.3% | Resale to Resale | Freehold |

| OUE TWIN PEAKS | $1,200,000 | 549 | $2,186 | $1,714,000 | 5/17/2013 | 8.6 | -$514,000 | -30.00% | -4.0% | New Sale to Resale | Leasehold |

| GRANGE INFINITE | $5,800,000 | 2573 | $2,255 | $8,236,533 | 9/25/2007 | 14.5 | -$2,436,533 | -29.60% | -2.4% | New Sale to Resale | Freehold |

| THE SAIL @ MARINA BAY | $2,430,000 | 1313 | $1,850 | $3,450,000 | 9/25/2013 | 8.7 | -$1,020,000 | -29.60% | -4.0% | Resale to Resale | Leasehold |

| THE SAIL @ MARINA BAY | $2,550,000 | 1184 | $2,154 | $3,600,000 | 4/4/2011 | 11.3 | -$1,050,000 | -29.20% | -3.0% | Resale to Resale | Leasehold |

| VIDA | $1,080,000 | 527 | $2,048 | $1,513,000 | 1/13/2011 | 11.6 | -$433,000 | -28.60% | -2.9% | Resale to Resale | Freehold |

| ONE SHENTON | $2,560,000 | 1572 | $1,629 | $3,567,120 | 2/9/2011 | 11.2 | -$1,007,120 | -28.20% | -2.9% | New Sale to Resale | Leasehold |

| MARINA BAY SUITES | $3,808,000 | 2045 | $1,862 | $5,304,000 | 5/26/2010 | 12.5 | -$1,496,000 | -28.20% | -2.6% | New Sale to Resale | Leasehold |

| SEASCAPE | $4,280,000 | 2164 | $1,978 | $5,924,100 | 4/28/2010 | 12.3 | -$1,644,100 | -27.80% | -2.6% | New Sale to Resale | Leasehold |

| REFLECTIONS AT KEPPEL BAY | $3,860,700 | 2271 | $1,700 | $5,339,200 | 4/26/2007 | 14.9 | -$1,478,500 | -27.70% | -2.2% | Sub Sale to Resale | Leasehold |

In the property market, exceptions are the norm

All of this goes to show that conventional wisdom doesn’t always hold true. The property market – especially one as dynamic as Singapore – can be unpredictable.

Sellers can still make losses in a booming market; and conventional beliefs about holding periods and sub sales can be proven wrong.

ALSO READ: Beyond 2022: How Singapore's development will affect the property market (Sembawang and Woodlands)

It’s possible that some, or perhaps even most, of these losses were due to exceptional circumstances: the death of a co-owner, drastic changes in income, or selling between family members (these may be at a steep discount, such as if someone sells to a sibling or child).

But it’s not impossible that it can happen, and this also means hope for home buyers. Don’t stop looking, because you can see here that at least 733 buyers managed to transact at a lower price – even in the 2022 property market.

Bagikan Berita Ini

0 Response to "5 interesting takeaways from the rare property losses in Singapore's booming market in 2022 - AsiaOne"

Post a Comment